At the

end of 2018, there is one big date to keep in mind

if you're

self-employed or a small business owner and that's

December 31st.

That's the

deadline for this year's special tax

deduction you can get

if you buy a new

:

F-150, F-250, F-350, F450, Super Duty

Trucks,

Transit, Transit

Connect,

Expedition,

Explorer, or Flex

Self-employed

persons or businesses who use this special

deduction are allowed to write off

up to

$500,000 worth of depreciable assets in the year

that they are purchased.

For businesses that do not

qualify for Section 179, there is another great tax break, but it

expires in 2019. Bonus Depreciation allows you to deduct 50%

of the cost of assets in the year of purchase. This deduction is allowed

even if you do NOT have income and has no max amount. You can

use this for an unlimited number of purchases, but the deduction is

only allowed for NEW assets. For used vehicles, this deduction

is not allowed, but Section 179 IS allowed. The bonus

depreciation deduction was at the 50% amount in 2017. In 2018

it will drop to 40% and in 2019 it will drop to

30%.

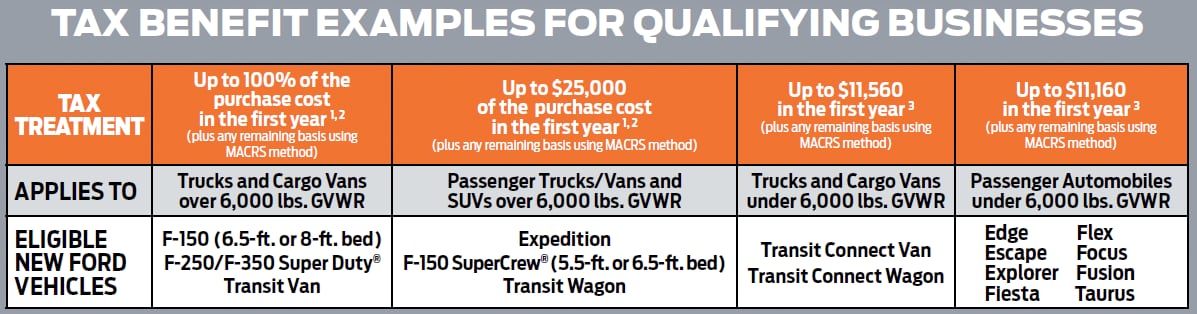

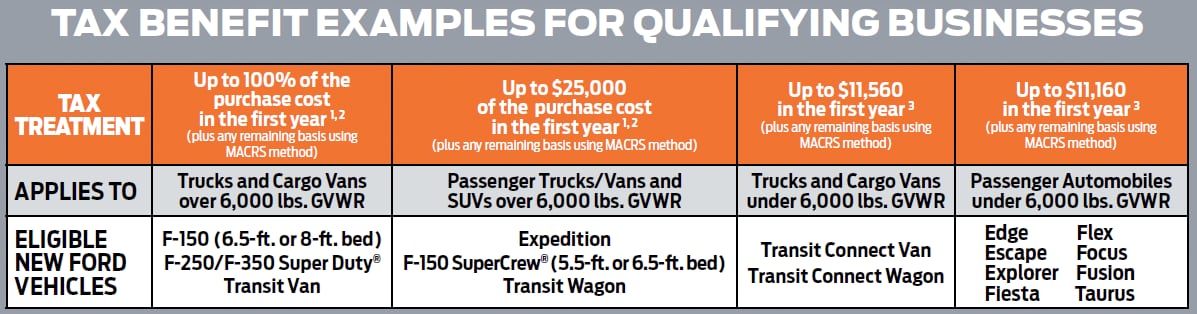

Limitations

- The vehicle must be used at least 50% for

business to qualify.

- Depreciation

limits will be reduced for personal use if the

vehicle is used for business less than 100% of the time.

- There are

top end deductions for different

classes of vehicles. For example, small cars under 6,000

lbs. are capped

at $11,060 of depreciation in the first

year.*

- SUVs and crossovers with

Gross Weight above 6,000-pounds are capped at

$25,000.*

- Trucks

and

vans with no rear passenger seating that are above 6,000-pounds do not

have a cap.*

- Every major

brand of pickup (1/2 ton and up) are over

6,000-pounds for purposes of this

deduction.

- There is a $500,000

cap.

- If you purchased more than

$2,000,000 in 2017 assets, then this will have the deduction

phased out.

- You have to have positive

income and not a net loss for the year.

If you meet these guidelines

• It's a great idea to move

those vehicle purchases you are planning, forward to 2017, to

take advantage of last minute tax

savings.

• You must purchase the vehicle

by December 31, 2018 to get the write-off on your

2018 taxes.

As always, check with your

tax advisor to see what works best for your situation, but if you are

doing some year-end planning, a new car might be the most fun way to

save on your taxes.

Take advantage of these tax deductions for

your small business when you purchase a New Ford Truck by December

31st!

If you are looking to take advantage

of this extension time is running out so consult Lakewood Ford to get

the returns your business

deserves. Contact Us Today!

Purchases - whether

paid for in cash or financed -

are eligible for tax benefits under Section 179, as long as the vehicle

is received by December 31, 2018.

*The information provided here is

intended as a general overview of the Section 179 Deduction. You should

always consult with a tax professional on business tax

deductions.

The

Ford F-series are the ultimate work truck. If you need to haul a big

load,

the F-250

,

F-350, F-450,

have impressive payload capacity. The guys who own work trust the capable

Ford Super

Duty Trucks.